Stock picking services can be the difference between earning a 10% annual return or a 110% annual return.

But let me be clear, stock picking services aren’t for the faint of heart.

Picking individual stocks is risky and is best suited to investors who have plenty of spare cash to put into the market.

We’ve tested the 11 most popular stock picking services on the market so you don’t have to.

Let’s get into it!

What Is The Best Website For Stock Picks?

Here's the tl;dr

- Ticker Nerd is best for investors that want to generate long-term wealth.

- The Motley Fool’s Everlasting Stocks is best for investors looking for stocks to “buy and hold forever”

- AAII Dividend Investing is designed for dividend investors (we recommend avoiding this service).

- Mindful Trader is best for experienced investors that want to day trade stocks.

- Seeking Alpha PRO is best for investors who love analyzing financial data.

- Morningstar Premium is best for investors who prefer reading detailed stock reports.

- The Motley Fool Stock Advisor is best for new investors that are looking for stock picks.

- Warrior Trading is designed for investors looking to learn how to day trade (we recommend avoiding this service).

- Alpha Picks by Seeking Alpha is best for investors looking for data-driven stock picks.

- Tim’s Alerts is best for day traders who are looking for daily recommendations.

- Zacks Premium is best for do-it-yourself investors.

How To Choose The Best Stock Picking Service

Picking the best stock picking service is almost as hard as picking stocks. There are so many options to choose from. All of them label themselves as the “best” showing impressive stock charts and testimonials. So how are you supposed to separate the gems from the junk?

Here’s how:

- Track record

The first and most important factor to consider is their track record.

What’s the point of spending your hard-earned money on a service that only sends stocks that lose money?

This is why you need to pay close attention to how often they get things right.

Of course past results don’t guarantee future success. But it will still give you an indication of the quality of their stock picks.

Remember even the best investors in the world don’t have a perfect track record. So don’t expect to find a stock picking service with a 100% success rate.

Any decent stock picking service will make it easy to view their track record. Steer clear of any services that hide their performance from potential subscribers.

- Your budget

Stock picking services aren’t free.

Most stock picking services cost at least $199 per year. Some can cost thousands of dollars per year.

The options you’ll be able to choose from will depend on how much you’re able to spend on the service.

Spending more on a stock picking service doesn’t guarantee you’ll make more money.

You should also factor in buying the actual stock picks in your budget.

- Your risk appetite

The service you pick should match your investment style.

There’s no point signing up for a stock picking service that focuses on penny stocks if the thought of losing 90% of your investment in 1 hour makes you feel sick to the stomach.

On the flip side if you’re looking to make high-risk high reward trades then signing up to a “buy and hold” stock picking service doesn’t make sense either.

Always check the service aligns with your risk tolerance before signing up.

- Your experience level

Some stock picking services can send 3-5 stocks per month. If you’re a new investor this can be overwhelming.

Especially if you only have a small amount of money to invest.

When you’re starting out you would likely need guidance on when to buy, hold, and sell.

Not all stock picking services share these insights and can leave you in the dark about what to do next.

Always check to see the level of information you get with the service and if they cater to beginners or seasoned investors. But if you're interested in learning more about the market then consider reading investing books or subscribing to investing Youtube channels.

- Customer support

The more customer support options you have the better.

It’s normally a good sign if you can contact customer support via live chat, email and phone.

While the opposite is true. If finding customer support is like trying to find Waldo then there’s a good chance you won’t get any help if you run into issues with the service.

Take a look at customer reviews on third-party sites like TrustPilot to get an idea of how much they care about their customers.

- Free trials and money-back guarantees

You’re already taking a risk buying individual stocks. You shouldn’t have to gamble with choosing a stock picking service too.

Luckily, most services offer some form of free trial or money-back guarantee. This means you can get a feel if the service is right for you without risking your money.

For example, at Ticker Nerd we offer a 30-day money back guarantee with no questions asked.

Make sure to read the fine print on their refund policy before signing up to avoid any headaches if you change your mind.

Should You Buy Recommendations from These Services?

Blindly buying every stock a service recommends can be a recipe for disaster.

I know this can sound like it defeats the purpose of signing up for a stock picking service but it’s important to do your own research before making an investment.

Regardless of how many five star reviews a stock advisory service has, it's still possible you could lose all of the money you put into their recommendations. Keep this in the back of your mind when choosing a service.

The 11 best stock picking services reviewed by our team

Our team personally signed up and tested each service on this list. It took over 40 hours of research and testing to be able to write this article. We did this so we can give you real insights into what you can expect with each service. We've covered most stock advisory services but there are some we've purposely left our considering they did not meet our criteria or were not popular enough to include.

1. Ticker Nerd

What do you get with Ticker Nerd?

If you’re looking for US stocks that are undervalued and have long term potential – Ticker Nerd could be for you.

Each month they send you a report that covers two stocks.

The reports cover:

- What the company does

- Investor sentiment from retail and institutional investors

- Why the company could become more valuable

- Risks that face the company

After signing up you also get access to their archive of previous reports that contains over 120 stocks.

The reports are written in plain english (so you don’t need a finance degree to read them).

They use a combination of proprietary software and human analysis to uncover stocks with potential.

Ticker Nerd is best suited to investors that are looking for stock ideas each month but also have a long term investing horizon. If you’re looking to make quick returns on penny stocks or swing trading then Ticker Nerd might not be the best option.

How much does Ticker Nerd cost?

Ticker Nerd offers one flat pricing option:

- $199 per year

Prices are in USD.

Ticker Nerd comes with a 30-day money-back guarantee to let you test the service risk-free.

For a limited time, you can get Ticker Nerd for 50% off using this link.

What is Ticker Nerd's track record?

Ticker Nerd launched in 2021, around the same time all of the GameStop madness was happening.

This is why the service was initially focused on looking for trending stocks that had solid fundamentals but could also spike from investor hype.

Over time the service shifted away from trending stocks. Instead focusing on high-quality, durable businesses that would grow steadily over time.

If we assess Ticker Nerd’s track record in its current form, the results are impressive.

As of 30 June 2023, Ticker Nerd has sent 36 stocks that have increased in value since sending it to their members.

With 10 of these stocks returning over 50% since they covered them.

So far in 2023, 10 out of 12 stocks they’ve covered have increased in value since they sent it to their members.

Does Ticker Nerd have a money back guarantee?

Ticker Nerd offers a 30 day money back guarantee if you change your mind after signing up.

To get a refund all you need to do is email hello@tickernerd.com and share the reason why you’d like to cancel.

What customer support options does Ticker Nerd have?

If you have questions or concerns you can contact customer support via email and live chat on the Ticker Nerd homepage.

Email: hello@tickernerd.com

Live chat: tickernerd.com

What we like about Ticker Nerd

- Balanced research that can be used by beginners and seasoned investors

- Provide buy, hold or sell analyst ratings for every stock

- Affordable, flat pricing option

- Solid track record

- Money-back guarantee

What we don’t like about Ticker Nerd

- Amount of stock reports can be overwhelming

- Only cover US stocks

Verdict: If you want to grow your portfolio, save time and get access to high-quality stock research backed by data then Ticker Nerd might be for you.

2. Motley Fool's Everlasting Stocks

What do you get with The Motley Fool's Everlasting Stocks?

Everlasting Stocks is a new service from Motley Fool that sends stock picks every quarter. What makes this product unique is that the stock picks are based on what the CEO Tom Gardner believes are stocks “any investor can buy and hold forever”.

You get access to 15 stock picks immediately after signing up as well as new stock picks every quarter (assuming you remain a paid member). You also get access to “expert analysis of new investing trends” although it's not clear what this actually involves.

The main selling point behind this service is that it's from the same team behind Stock Advisor who’s average return is 254%.

One point to consider is that the Motley Fool has covered a lot of mainstream stocks everyone has heard of. Think tech companies like Netflix, Shopify and Tesla. By covering a few outsized winners they are able to offset the many stocks they’ve covered that have lost value.

Another observation was after signing up for the service I started being flooded with sales emails for their other paid services. In my opinion this hurt my experience with the service, but might not bother other people.

How much does Everlasting Stocks cost?

Motley Fool Everlasting Stocks has two pricing options:

- $39 per month

- $99 for the first year (for new members only) then $299 per year for every following year

All prices are in USD.

Both options come with a 30 day money back guarantee to let you test the service first before paying.

What is Everlasting Stocks' track record?

Motley Fool was founded in 1993 by two brothers – Tom and David Gardner. Motley Fool now boasts over 1.5 million subscribers according to their website.

Since launching Everlasting Stocks in September 2018, its stock picks have returned 18.61% while the S&P 500 has returned 17.70% over the same time period (returns as of 30 June 2023).

The service has covered some winners that have performed well such as Tesla. But it has also sent some poor recommendations including Silicon Valley Bank which collapsed in March 2023.

Does Everlasting Stocks have a money back guarantee?

Motley Fool offers a 30 day money back guarantee for its Everlasting Stocks service. You’ll need to submit a request via their help center which can be quite tricky to find.

Although from my experience when I requested a refund it was processed within 24 hours.

What customer support options does Everlasting Stocks have?

Motley Fools offers customer support via:

- Email: membersupport@fool.com

- Phone: (888) 665-3665 (available 9:30am to 4pm Eastern Time, Monday to Friday).

- Customer Help Center: https://support.fool.com/hc/en-us

What we like about Everlasting Stocks

- Simple dashboard that ranks top ten stock picks

- Plenty of customer support options

What we don’t like about Everlasting Stocks

- Track record is questionable

- Flooded with sales emails after signing up

- Price increases after your first year as a member

Verdict: Everlasting Stocks is suited to investors that are comfortable buying and holding stocks forever. Investors that are looking for high risk high reward stock picks should consider alternatives.

Read our detailed Motley Fool review here.

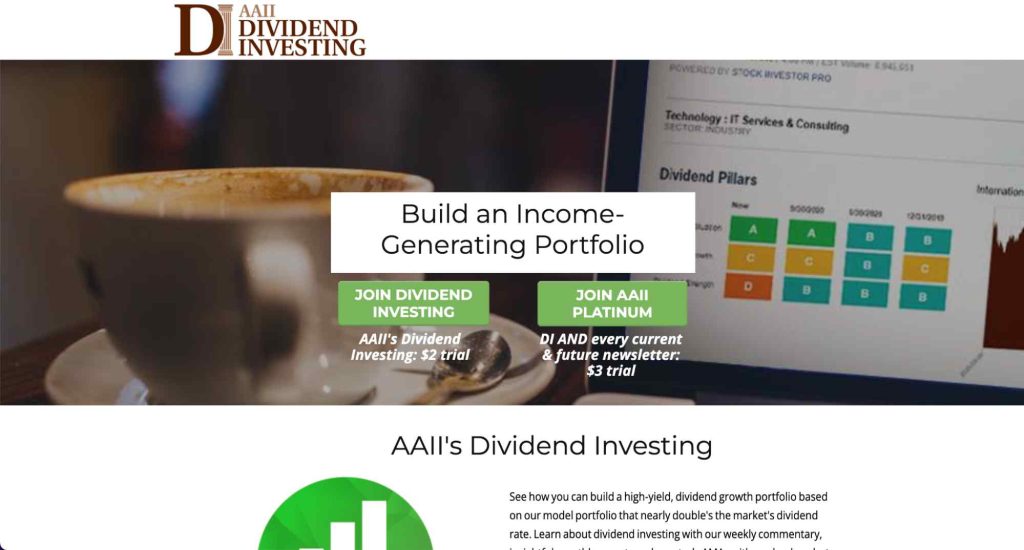

3. American Association of Individual Investors Dividend Investing

What do you get with AAII Dividend Investing?

American Association of Individual Investor’s (AAII) Dividend Investing service (I know it’s a mouthful) focuses on finding high yield dividend growth. The website claims its model portfolio generates nearly double the market’s dividend rate although no proof was provided behind this claim.

You can sign up for the service on a paid $2 trial to get access for 30 days.

Here’s what’s included in the service:

- Weekly webinars that discuss investing topics

- AAII’s Monthly Journal that contains market analysis

- Weekly stock picks based on their screening process

- Access to the AIII community

- An annual tax guide for US investors

After I signed up to the trial it wasn’t clear how I can access any of these features.

How much does AAII Dividend Investing cost?

I couldn’t find how much the service costs after the $2 trial finishes.

I had to sign up to the trial first where I then received an email saying the membership will automatically renew at the end of the 30 days for $248.

I found this to be slightly misleading, damaging my trust in the service.

What is AAII Dividend Investing's track record?

The American Association of Individual Investors is an independent, nonprofit that was formed in 1978. The purpose of the AAII is to help individual investors manage their own assets through resources and guides.

I couldn’t find any information about when the AAII Dividend Investing service was launched or the track record of its recommendations.

Does AAII Dividend Investing have a money back guarantee?

AAII’s Dividend Investing service does not come with a money back guarantee.

What customer support options does AAII Dividend Investing have?

If you check on the AAII site you’ll struggle to find any mentions of customer support.

The only reason I was able to find how to reach was through a payment receipt email I signed up for the trial.

You can contact customer support using the options below:

- Email: members@aaii.com

- Phone: (312) 676-4300

It’s unclear how long it will take to expect a response from the service using the methods.

What we like about AAII Dividend Investing

- I didn’t receive anything after paying for the trial so I can’t comment on what you get with the membership

What we don’t like about AAII Dividend Investing

- Unclear pricing

- No examples of what you get as a member

- No proof of track record

Verdict: Based on my experience with this service I would recommend saving your money and avoiding this one.

4. Mindful Trader

What do you get with Mindful Trader?

Mindful Trader is a stock picking service designed for swing trading. Swing trading is a high risk strategy where you buy a stock and sell within a few days of buying. The idea is to sell at a profit from swings in the stock price. This service is suited to investors who are comfortable making losses.

There’s a few reasons this strategy is risky. Firstly, it's hard to predict the perfect time to sell a stock and lock in a profit. When the market is open, stock prices can change in seconds. A minute delay can be the difference between making a profit or loss. Secondly, since the fluctuations in price can be quite small (1% to 5%) you need to trade large amounts of capital or use leverage to generate significant returns. This means you have more to lose if you get things wrong.

Mindful Trader shows you the exact trades made by the founder Eric Ferguson as well as access tutorials and commentary from Eric behind his strategies.

Eric uses an algorithmic backtesting strategy to come up with his stock picks. This means he uses an algorithm to come up with a set of rules of what to buy and when to sell. Then based on these rules he can “test” the returns the algorithm would have generated over the years. This gives the strategy a “track record” that can be used to predict future returns.

Backtesting isn’t fool proof and doesn’t guarantee the algorithm will get things right in the future, which Eric admits on his site.

Here’s what’s included in the service:

- Daily stock picks and options picks (Eric makes 1-3 trades per day)

- Stock and options trading tutorials

- Commentary from Eric behind the trades he’s making

How much does Mindful Trader cost?

Mindful Trader only has one pricing option – a $47 monthly subscription.

All prices are in USD.

What is Mindful Trader's track record?

Unlike most stock picking services Mindful Trader goes into a lot of detail behind its track record.

This video shows the trading results over a two week period based on the stocks recommended by the service. In the video Eric shows that his stock picks generated a 10% return over the past week. But mentions that the previous week ended in a loss. He goes on to state that this is completely normal and expected following a swing trading strategy.

Another video discusses how Eric was able to generate a 43% return in 30 days using his options trading strategy.

These videos give some insight into what to expect following the advice in the service. Although it’s important to remember that these returns are over specific time periods. There isn’t any data that shows how the stock picks have performed since the service began.

Does Mindful Trader have a money back guarantee?

Mindful Trader does not offer a money back guarantee.

What customer support options does Mindful Trader have?

Mindful Trader offers only one option for customer support. You can contact Eric directly via email via eric@mindfultrader.com.

Eric says “you can expect a fast response” from him. He doesn’t reply to customer support questions on weekends or holidays.

What we like about Mindful Trader

- Transparency behind results and trading strategy

- Detailed disclaimers to help investors understand what they’re getting into

What we don’t like about Mindful Trader

- Limited pricing options

- Limited customer support

- No money back guarantee

Verdict: If you’re an experienced trader that is comfortable buying and selling stocks everyday this service could be for you.

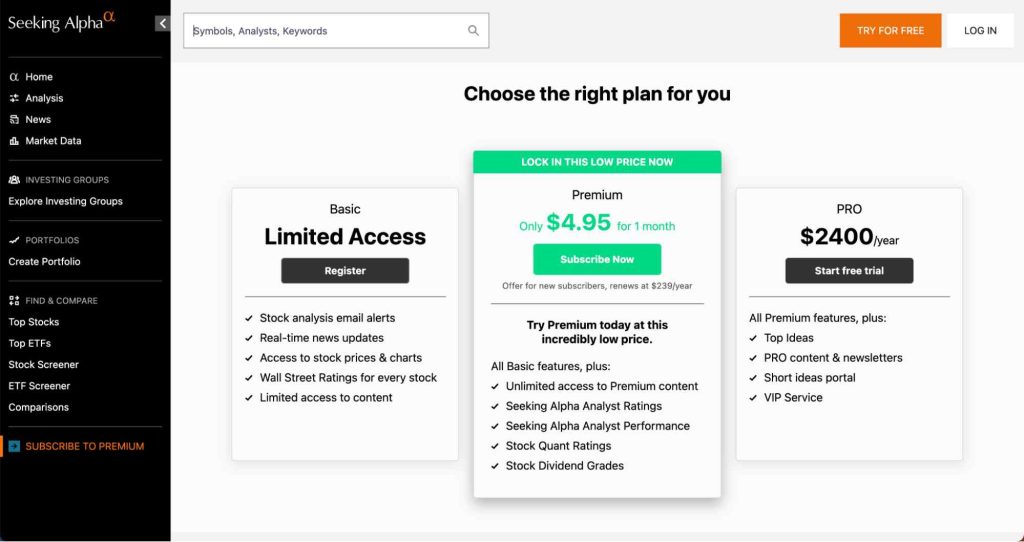

5. Seeking Alpha PRO

What do you get from Seeking Alpha PRO?

Seeking Alpha PRO is the most expensive service offered by Seeking Alpha coming in at $199 per month (billed annually at $2,400).

The service comes with all the features offered in it’s Basic and Premium services which include:

- Stock analysis email alerts

- Real-time news updates

- Live stock price charts and data

- Wall Street Analysts ratings

- Access to articles contributed by Seeking Alpha users

- Analyst Ratings from Seeking Alpha’s analysts

- Performance of Seeking Alpha’s analysts

- Quantitative Ratings for all stocks

- Dividend Grades for all stocks

On top of these features Seeking Alpha PRO comes with:

- Top Ideas (exclusive articles from top rated analysts)

- PRO content and newsletters (it’s not clear exactly what these are or how to access them)

- Short ideas

- VIP Service (again it’s not clear what this includes or how to access it)

This video goes into more detail about what you get in Seeking Alpha PRO and how to get the most out of the service.

How much does Seeking Alpha PRO cost?

Seeking Alpha PRO isn’t cheap. There’s only one pricing option which is a total annual bill of $2,400.

The service does offer a 14-day free trial that lets you test-drive the membership.

What is Seeking Alpha PRO's track record?

Seeking Alpha PRO doesn’t provide stock picks. So it’s hard to measure its track record.

The service gives you access to data and information to help you come up with your own stock picks.

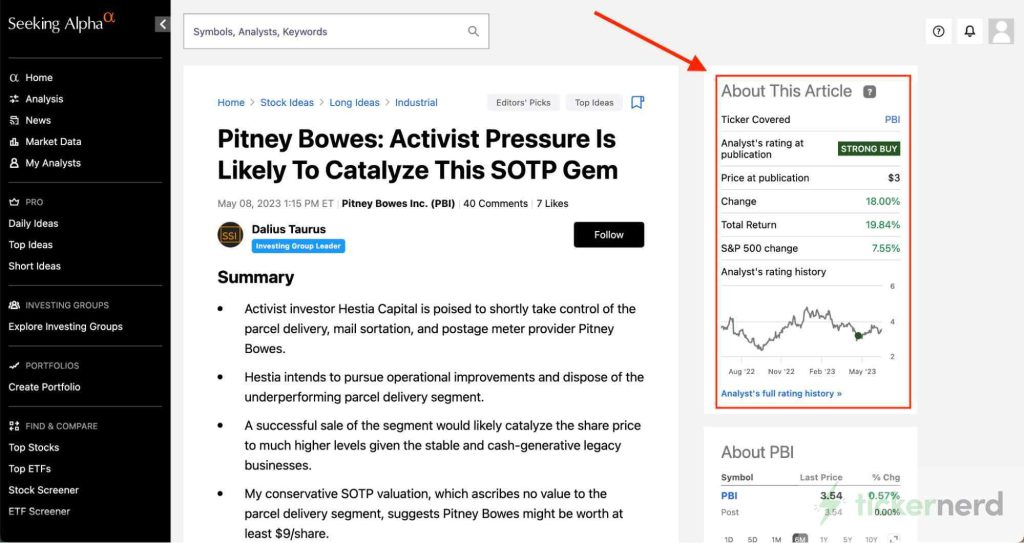

Seeking Alpha relies on contributors to publish articles that analyze different stocks. On these articles you can see:

- The author’s recommendation on the stock e.g. buy, hold, sell.

- The stock price when the article was written

- How the stock has performed since the article was written

- How the stock has performed compared to the S&P 500 over the same time period

Although it's worth noting that you don’t need a Seeking Alpha PRO membership to see the “track record” of Seeking Alpha articles. This data is also shown in the Premium subscription which costs $239 per year (a fraction of Seeking Alpha PRO). The only difference with Seeking Alpha PRO is you get exclusive access to “Top Ideas” articles. It’s not clear what the difference is between articles that are Top Ideas and the other premium articles.

Does Seeking Alpha PRO have a money back guarantee?

Seeking Alpha PRO comes with a 14 day free trial and a money back guarantee if you cancel within 30 days of becoming a paid member.

According to Seeking Alpha’s refund policy, you will only be refunded for 11 months of the annual subscription. This means if you cancel within 30 days of signing up for Seeking Alpha PRO you will still have to pay for the first month which costs $199.

What customer support options does Seeking Alpha PRO have?

Seeking Alpha offers plenty of customer support options.

It has a Knowledge Base that answers over 200 customer questions.

You can also contact them via phone (1-347-509-6837) and email (subscriptions@seekingalpha.com).

What we like about Seeking Alpha PRO

- Access to exclusive analyst insights

- Transparent track record behind each article

- Powerful stock screening and analysis features

What we don’t like about Seeking Alpha PRO

- Comes at a high price that is unaffordable for most investors

- Doesn’t offer significantly more value than Seeking Alpha Premium which costs a tenth of the price

- First month isn’t refunded if you change your mind

Verdict: If you’re considering Seeking Alpha PRO I would suggest saving your money and signing up to Seeking Alpha Premium instead. You can get most of the value from Seeking Alpha PRO by signing up to Seeking Alpha Premium while paying a tenth of the price.

6. Morningstar Premium

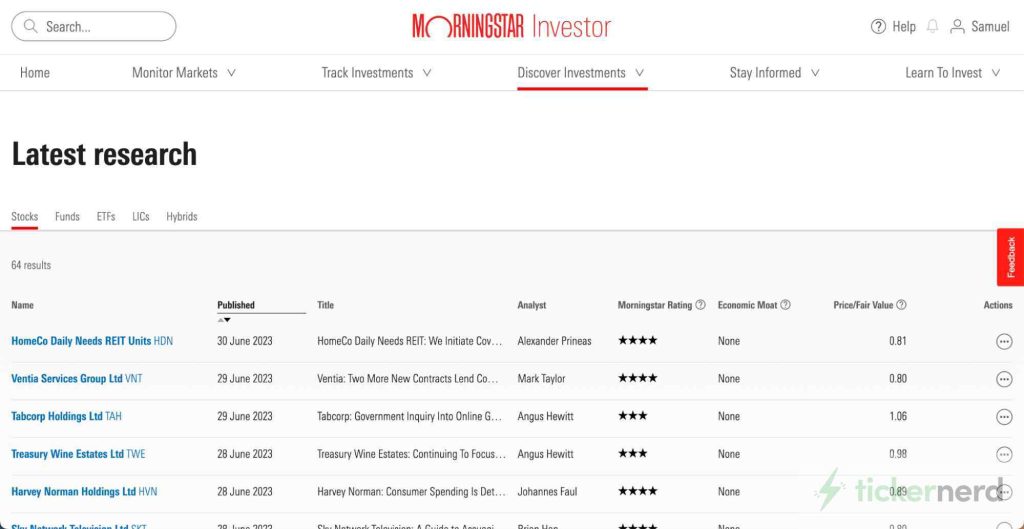

What do you get with Morningstar Premium?

Morningstar has been around for a while. The investment research firm was founded in 1984 and is publicly traded on the Nasdaq ($MORN).

Its paid subscription Morningstar Premium gives you unlimited access to:

- Morningstar Analyst ratings and analysis

- Stock screening based on growth, income, financial strength, etc.

- Insights into your stock portfolio

How much does Morningstar Premium cost?

Morningstar Premium has two pricing options:

- $34.95 paid monthly

- $249 paid annually (save 41% compared to the monthly)

The service offers a 7 day free trial and doesn’t require any credit card details to get started.

What is Morningstar Premium's track record?

Morningstar doesn’t recommend specific stocks but rather gives you a “Morningstar Rating” for thousands of stocks around the world.

The Morningstar Rating ranges from one to five stars. The methodology behind the rating is complex. In simple terms the rating is calculated based on a risk-adjusted view of whether a stock is over or undervalued. The ratings are updated at the end of every month.

It's worth noting that Morningstar also offers nine different managed funds that retail investors can put money into. It’s worth keeping an eye on how these funds perform to give you an idea of how much trust you should put into Morningstar’s research.

Does Morningstar Premium have a money back guarantee?

Morningstar Premium doesn’t have a money back guarantee. If you change your mind after paying for the subscription you’ll be refunded a prorated amount based on the amount of time left before your renewal date.

For example, if you cancel at the end of the first month after signing up for an annual subscription you’ll be refunded for 11 months worth of access.

What customer support options does Morningstar Premium have?

You can access Morningstar customer support via the following options:

- Help Center

- Email: productinfo@morningstar.com

- Phone: +1 312 696-6000

What we like about Morningstar Premium

- Morningstar has been around for over 35 years

- Its ratings are trusted by institutional investors

- Competitive pricing

What we don’t like about Morningstar Premium

- Still requires a lot of manual research to find stock opportunities

- Overwhelming amount of information

- Lack of clear stock picks

Verdict: Morningstar Premium would suit investors who are already spending a lot of time researching stocks and are comfortable doing their own research.

7. Motley Fool Stock Advisor

What do you get with The Motley Fool Stock Advisor?

Motley Fool Stock Advisor is probably the most well known stock picking service on the market. According to the Motley Fool over a half a million investors currently use the service. This doesn’t mean the service is perfect. We’ll get into the good, bad and the ugly in the sections shortly. But first let's talk about what you get in the service.

After signing up you’ll get access to:

- The list of ten top ranked stocks in Stock Advisor

- Recommendations for each stock on the list

- Analysis and updates for each recommended stock

- Investment articles published on the Motley Fool blog

- The Motley Fool community

How much does The Motley Fool Stock Advisor cost?

Motley Fool Stock Advisor has two pricing options:

- $39 paid monthly

- $99 paid annually for the first year*, then $199 each year after that

*This price is only available to new members.

At the time of writing Stock Advisor does not offer a free trial.

What is The Motley Fool Stock Advisor's track record?

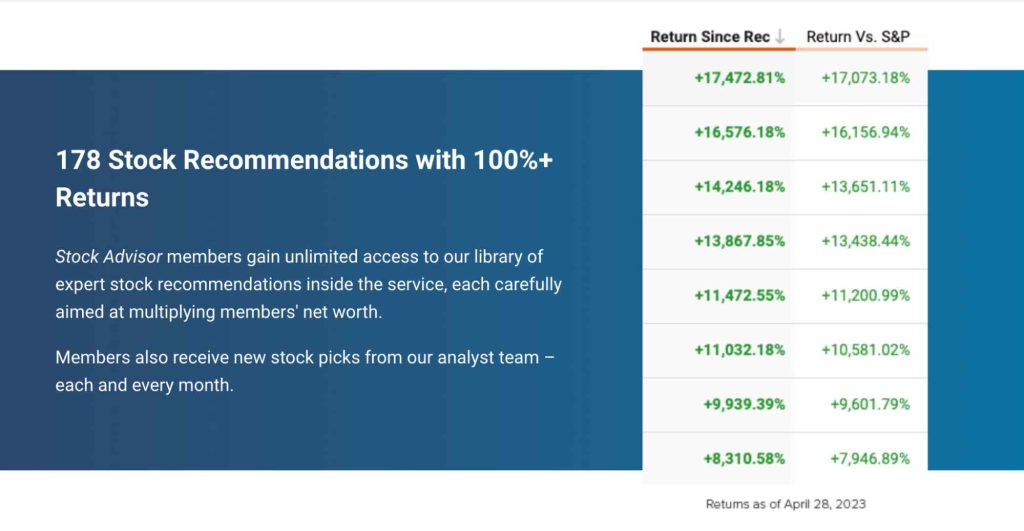

The Motley Fool claims Stock Advisor has recommended 178 stocks that have returned over 100% as of April 28 2023.

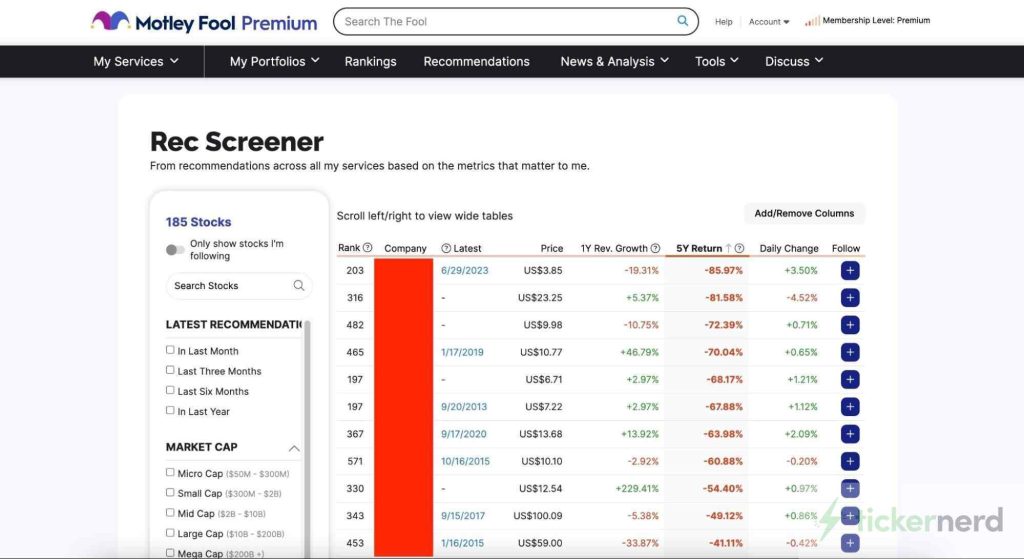

As with any stock picking service not every recommendation is going to be a home run. If you blindly follow every recommendation you can lose money.

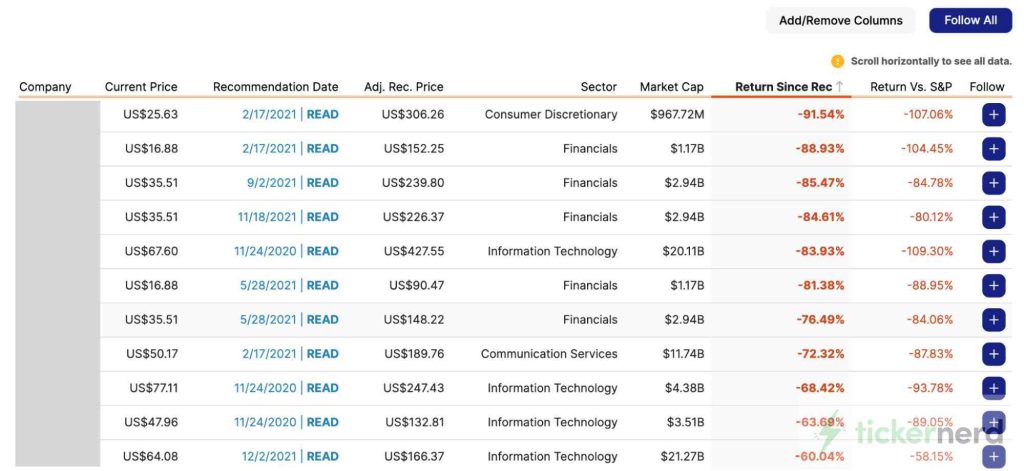

We can see in the image above that the service has covered multiple stocks that have lost over 40% over a five year period. The reason I included this is to act as a reminder that there’s no such thing as a perfect stock picking service. Despite this, Stock Advisor’s track record is still impressive and these losses don’t outweigh the wins.

It’s also a little known fact that Motley Fool also operates a hedge fund that invests in the majority of the stocks the service recommends. Due to the large following of the service it is possible that it can manipulate trading activity by promoting holdings owned by Motley Fool’s hedge fund. A Reddit user did a deep dive into this with some fascinating findings.

Does The Motley Fool Stock Advisor have a money back guarantee?

Motley Fool Stock Advisor comes with a 30 day money back guarantee. This means if you change your mind within 30 days of signing up you’ll get a full refund no questions asked.

What customer support options does The Motley Fool Stock Advisor have?

Same as its other service Everlasting Stocks, Stock Advisor offers the following customer support options:

- Email: membersupport@fool.com

- Phone: (888) 665-3665 (available 9:30am to 4pm Eastern Time, Monday to Friday).

- Customer Help Center: https://support.fool.com/hc/en-us

What we like about The Motley Fool Stock Advisor

- Beginner friendly research

- Rankings with top stock recommendations

- Discount for new members

What we don’t like about it The Motley Fool Stock Advisor

- Stock reports are quite thin compared to other competitors

- Lack of transparency between Stock Advisor and Motley Fool’s hedge fund

Verdict: The Motley Fool’s Stock Advisor would suit investors who are just starting their investment journey and need direction on stocks to consider.

Read our Motley Fool review here.

8. Warrior Trading

What do you get with Warrior Trading?

Warrior Trading is a day trading service run by Ross Cameron who is a full-time day trader. The site offers several membership types depending on what you need help with. All of the products are focused around day trading stocks.

Here’s a breakdown of each product:

- Warrior Starter

- Access to Day Trading Basics Course – 18 hours of content

- Access to Ross's Complete Daily Low-Latency Broadcast

- View-Only Chat Room Access

- Can only access customer support via email

- Warrior Pro

- Access to 10+ courses – over 200 hours of content

- Ross's Complete Daily Low-Latency Broadcast

- Full Chat Room Access

- Customer support options include email, live chat and live group mentoring

- Warrior Pro (plus 1 year trading tool access)

- Everything included with Warrior Pro but also includes a 1 year trading tool subscription

The appeal of the membership is getting access to educational course content and live content from Ross and the community.

How much does Warrior Trading cost?

Warrior Trading’s products are quite expensive when compared to the other services we’ve covered in this article.

- Warrior Starter – a one-time fee of $997

- Warrior Pro – a one-time fee of $3,997

- Warrior Pro (plus 1 year trading tool access) – $8,761

Warrior Trading also offers a paid two week trial for $19.

My guess behind why the prices are so high is the fact that Ross (the founder) live streams his trading sessions everyday for paying members. This adds up to tens of hours of live content every week.

What is Warrior Trading's track record?

According to the most recent verified earnings statement, Ross started with a balance of $583.15 on January 1 2017 and has generated $10,524,116 in total gains as of May 2023.

This level of earnings is hard to believe. You should not expect to get the exact same results as Ross. It’s extremely difficult to replicate every single trade that Ross makes. Even a short delay of a few minutes between trades can be the difference between making a loss or profit.

Warrior Trading was also sued by the Federal Trade Commission (FTC) in April 2022 for more than $2.9 million. The reason? For making misleading and unrealistic claims that customers could generate massive profits from following Ross’ trading systems. Warrior Trading was forced to refund more than 20,00 customers who paid thousands of dollars for training.

Does Warrior Trading have a money back guarantee?

Warrior Trading does not offer a money-back guarantee but was forced to refund thousands of customers after the lawsuit from the FTC.

What customer support options does Warrior Trading have?

The level of customer support you can access depends on the Warrior Trading membership you sign up for.

Warrior Starter can only access customer support via email – team@warriortrading.com

While both Warrior Pro memberships come with email customer support, live chat and live group mentoring.

What we like about Warrior Trading

- Live trading sessions

- Over 200 hours of educational content

What we don’t like about Warrior Trading

- History of misleading customers who spent thousands on the membership

- Doesn’t offer money back guarantees or refunds

- Price is unaffordable for most investors

Verdict: It’s hard to trust this service after the recent lawsuit. There are safer and cheaper options you can use if you’re looking for a day trading service.

9. Seeking Alpha – Alpha Picks

What do you get with Alpha Picks by Seeking Alpha?

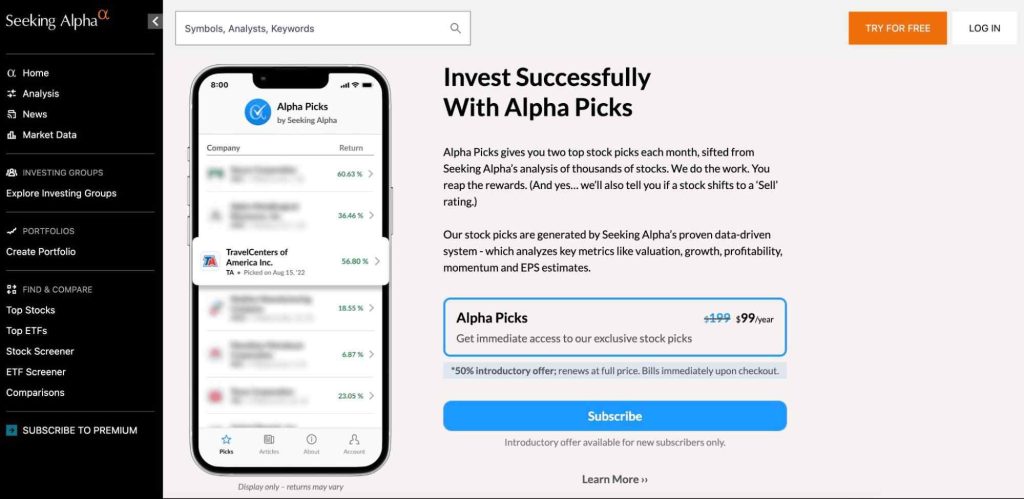

Alpha Picks by Seeking Alpha is a stock picking service that is offered outside of Seeking Alpha’s other memberships. As an Alpha Picks member you’ll get two stock picks each month based on Seeking Alpha’s stock picking criteria.

Each month you’ll get:

- Two stocks to invest in for the long-term

- An explanation of what the company does, why the stock is rated highly, and why Seeking Alpha believe it has potential

- An alert if Seeking Alpha thinks you should sell one of the stocks currently in the service

- Regular updates on current ‘Buy' recommendations

According to the Alpha Pick’s website the stock picking criteria is based on the following rules:

- Each stock must hold a Strong Buy Quant rating for a minimum of 75 days

- Has a market cap greater than $500M

- Is traded as common stock, only (no ADRs)

- Stock price greater than $10

- Highest rated stock at the time of selection that has not been previously recommended within the last year

How much does Alpha Picks cost?

Alpha Picks only has one pricing option:

- $199 per year, (new subscribers can get 50% off the first year)

All prices are in USD.

The service doesn’t offer a free trial or refunds. The reasoning behind this is that it wouldn’t be fair to allow investors to join, copy the most valuable recommendations, and then cancel.

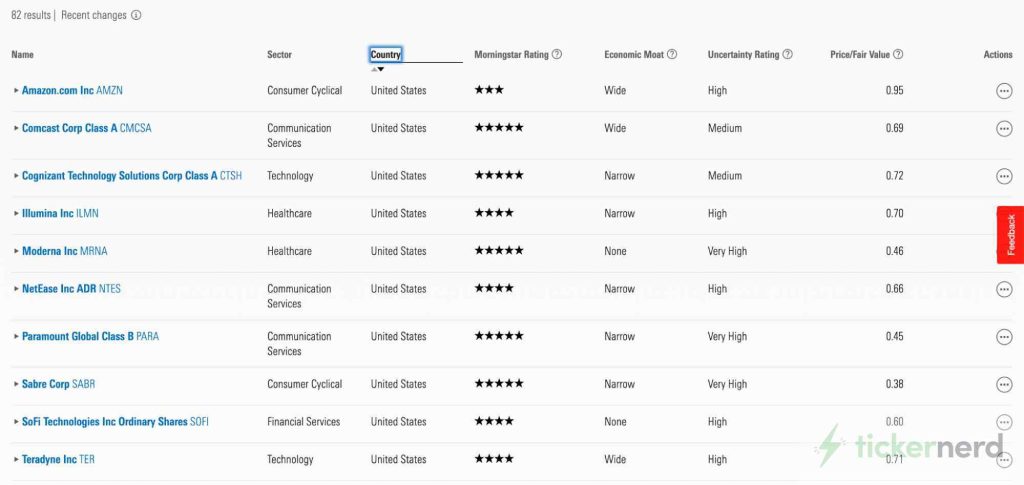

What is Alpha Picks' track record?

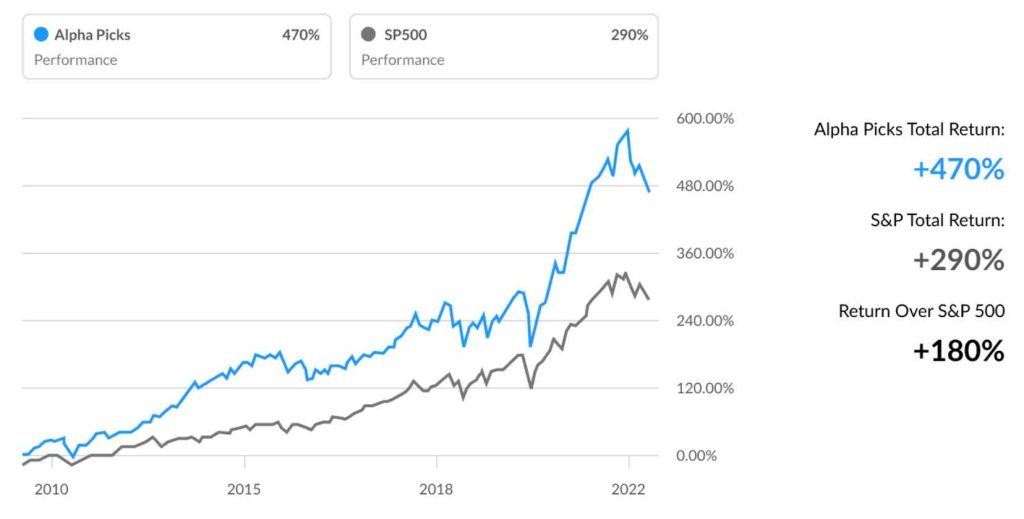

If you look up reviews for Alpha Picks there’s a good chance you’ll see the graph shown above.

What most reviews forgot to mention is these results are back tested results of following Alpha Picks’ stock recommendations. This means Alpha Picks didn’t actually invest to get these results. Relying on back testing can be risky, since a back tested strategy can have exceptional performance historically but could perform poorly in the future.

In theory, to generate these returns you would also have to implement every single buy, hold and sell recommendation provided by the service. This isn’t realistic or feasible for most investors.

Does Alpha Picks have a money back guarantee?

Alpha Picks does not come with a money back guarantee or provide refunds of any kind.

What customer support options does Alpha Picks have?

Alpha Picks uses the same customer support options available for other Seeking Alpha products.

This includes the Knowledge Base that answers over 200 customer questions.

As well as the same phone (1-347-509-6837) and email (subscriptions@seekingalpha.com).

What we like about Alpha Picks

- Leverages data from other Seeking Alpha products

- Simple report that any investor can understand

What we don’t like about Alpha Picks

- Relies heavily on back testing

- No free trial

- No refunds or money back guarantee

Verdict: If you’re looking for stock picks using a data-driven back tested strategy then Alpha Picks could be for you.

10. Tim's Alerts

What do you get with Tim's Alerts?

Tim’s Alerts is a stock picking service run by Timothy Sykes. Sykes is a controversial figure in the investing space, famous for his aggressive marketing strategies.

With Tim’s Alerts you get:

- Daily Chatroom Access

- Daily 5-10 Stock Watchlist

- SMS, Email, and Push Alerts

- ProfiDing Trade Alerts

Tim’s Alerts is focused on trading and shorting penny stocks. His strategies are suited to experienced traders who are comfortable with high levels of risk.

How much does Tim's Alerts cost?

Tim’s Alerts has two pricing options:

- $74 per month

- $697 per year

All prices are in USD.

Tim’s Alerts doesn’t offer a free trial or refunds. Keep this in mind before signing up.

What is Tim's Alerts' track record?

You can see the history of all the trades Tim makes on his site profit.ly. This includes whether the trade was profitable or not as well as comments from Tim explaining his thinking behind each trade.

According to the site, as of July 5 2023 Tim has made:

- 7,813 trades

- 5,984 of these trades were profitable

- 1,829 of these trades were unprofitable

- His winning percentage is 76.59%

- His average gain per trade is $1,586

- His total profits from trading are $7,474,370

Although it appears all of these figures are self-reported and aren’t from a verified source like a brokerage account. Which is why I would recommend taking these figures with a grain of salt.

Does Tim's Alerts have a money back guarantee?

Tim’s Alerts does not come with a money back guarantee or provide refunds of any kind.

What customer support options does Tim's Alerts have?

Tim’s Alerts offers two customer support options:

- Contact via email contact form

- Contact via phone – (205) 851-0506

It’s not clear how long it will take to get a response from their customer support team.

What we like about Tim's Alerts

- Sends investors frequent alerts through different channels e.g. email, SMS

- Provides a daily watchlist of 5 to 10 stocks

What we don’t like about Tim's Alerts

- No money back guarantee

- No free trial option

- Questionable claims and marketing tactics

Verdict: The marketing material behind Tim’s Alerts feels similar to “get rich quick schemes”. The service appears to be designed for experienced investors who are comfortable trading daily with a high level of risk.

11. Zacks Premium

What do you get with Zacks Premium?

Zacks is a well known name in the investing game. They’ve been giving investors access to high quality stock research since 1978.

Zacks provides a ton of free stock research and analysis. But you’ll need to sign up to Zacks Premium if you want access to their exclusive tools and resources.

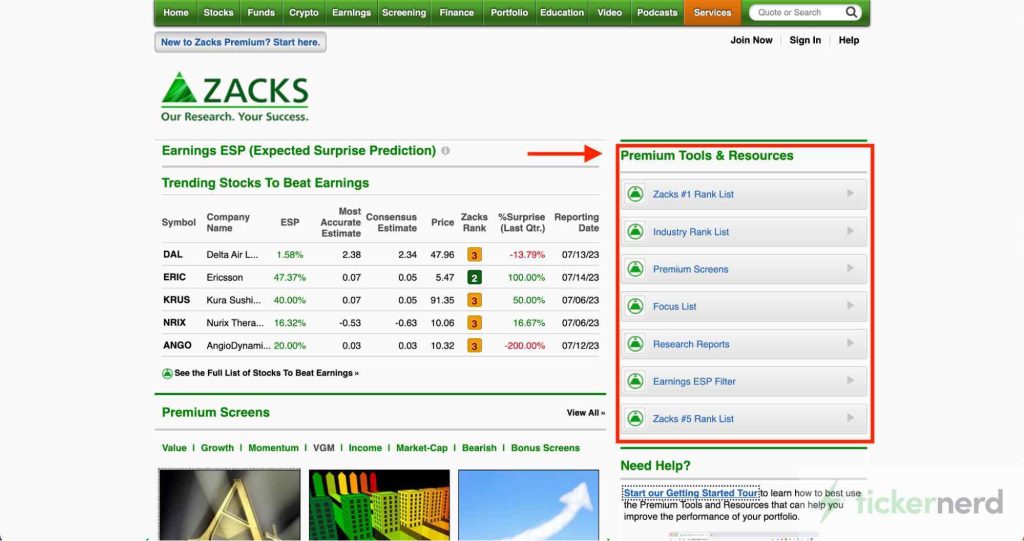

These premium tools and resources include:

- Zacks #1 Rank List – this is a private list of top rated stocks to buy based on analysis from the Zacks team.

- Industry Rank List – Zacks ranks all the stocks within different industries to help with your stock research.

- Premium Screens – this lets you pick and choose pre-built screens from the Zacks team that are based on different themes e.g. undervalued stocks, recent price momentum, stocks to short now, etc.

- Focus List – this list is a portfolio of 50 top long-term stocks that have been hand picked by the Director of Research at Zacks

- Research Reports – over 1,000 detailed reports that analyze publicly traded US stocks.

- Earnings ESP Filter – this filter gives you a list of stocks that are likely to have a positive or negative earnings surprise.

- Zacks #5 List – this is a private list of top rated stocks to sell based on analysis from the Zacks team.

Zacks Premium is the entry-level option out of Zacks paid services.

How much does Zacks Premium cost?

Zacks Premium only has one pricing option – $249 charged annually.

What is Zacks Premium's track record?

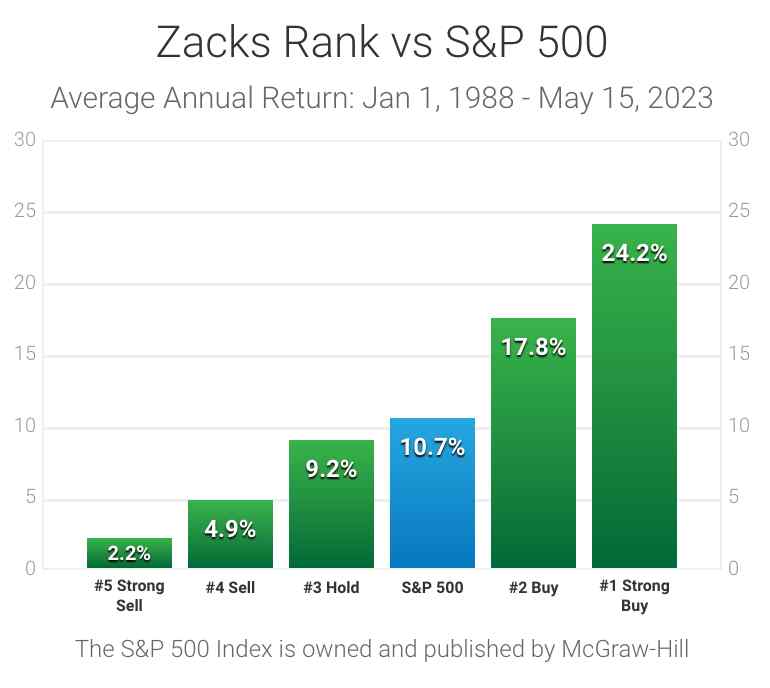

Zacks’ track record is impressive. Especially considering they’ve been in the investing game for over 30 years. According to their website the stocks covered on the Zacks #1 List has more than doubled the S&P 500 with an average gain of 24.2% per year from January 1, 1988 to May 15, 2023.

Although, it's not clear how this performance was calculated as the Zacks #1 List is constantly changing with stocks rising and falling in the list. This makes it difficult for investors to copy every single stock pick recommended by the service.

Does Zacks have a money back guarantee?

Zacks’ offers a generous 90 day guarantee that entitles you to a full refund if you’re not happy with the service.

They also offer a free 30 day trial to help you see if the service is right for you.

What customer support options does Zacks Premium have?

Zacks offers plenty of customer support options that are specific based on the service you are using.

You can visit their contact page for the full list of customer support options.

What we like about Zacks Premium

- Zacks has been in the industry for over three decades

- Detailed rankings based on earnings surprises

- Pre-built screeners to save time

What we don’t like about Zacks Premium

- Can be overwhelming for beginner investors

- Time consuming to trawl through all the information shared in the service

Verdict: Zacks Premium gives you a solid foundation for your stock research. The service is suited to investors who are happy spending hours on research each week.

Frequently asked questions (FAQs)

It’s almost impossible to answer this. The reason is every stock picking service has a different approach to measuring its track record.

Some services like Alpha Picks by Seeking Alpha base its track record on how its picks would have performed historically versus actually buying the stocks.

While other services like the Motley Fool and Zacks use rankings for the stocks they recommend. These rankings are constantly changing. This makes it difficult to calculate the return of each recommendation they make.

This also means the investors that use these services can have completely different experiences depending on when they signed up and how long they used the service.

Remember, regardless of which service you use, luck and hard work are going to play a massive role in whether you make a profit or a loss.

Investors pay a fee (this can be monthly, annual or one-off) for the stock picking service to send stock recommendations based on a specific criteria.

Each service will use its own unique criteria depending on the style of investing e.g. penny stocks, day trading, long term picks, etc.

The recommendations are usually delivered via an email newsletter or rankings list (sometimes a combination of both).

This is a great question. Rather than giving you my opinion, I’m going to let two of the arguably best long term investors in the world answer this: Warren Buffett and Charlie Munger.

Here’s the criteria they use when deciding which companies to invest in:

Do you understand how the business makes money?

Buffett and Munger invest in businesses they understand and avoid those they don't. They want to know how a business makes money and how it can continue to do so in the future. This principle is part of the “circle of competence” concept: stick to what you know.

Does the business have a competitive advantage?

This is a non-negotiable for Buffett and Munger. The business needs to have a competitive advantage or “economic moat”. Competitive advantages include things like brand reputation, patents, cost advantages, network effects, etc. The thinking behind this is that the competitive advantage(s) will protect the company from competitors and allow it to maintain its profitability over the long term.

Is the business run by a stable and high-quality management team?

Buffett once said, “You can't make a good deal with a bad person.” Integrity, talent and passion for the business are qualities you need to look for in the management team. High levels of insider ownership is another signal to pay attention to as this usually means the management team has a strong incentive to continue growing the business.

Does the company have a history of strong financial performance?

This includes consistent earnings, high return on equity, and low levels of debt. They look at various financial ratios and other metrics to evaluate a company's financial health.

Is it a simple and profitable business?

The two prefer companies that are already profitable and have simple business models. Which is why they haven’t invested in most technology stocks (with Apple being the notable exception).

Buffett has often said that he looks for businesses that can be run by a ham sandwich, meaning the business model is so simple that it doesn't need a genius management team to run profitably.

Is the company undervalued or fairly valued?

Once a company meets the above criteria, Buffett and Munger then consider whether the company is trading at a fair price. They use a variety of valuation methods, like discounted cash flow analysis, to estimate a company's intrinsic value. If the market price is significantly below this intrinsic value, they may consider it a good investment.

We tested a bunch of the best investment newsletters on the market. The findings might shock you.