InMode Ltd. is a prominent player in the field of medical aesthetics, providing innovative, energy-based, minimally invasive surgical solutions. Despite operating in a competitive industry, the company has demonstrated consistent growth and profitability, backed by its cutting-edge technologies and unique treatment methodologies.

Terex Corporation is a global manufacturing company delivering lifting and material processing products and services across various industries such as construction, mining, and energy. The company's diversified revenue streams and steady growth across different sectors make it a fascinating prospect.

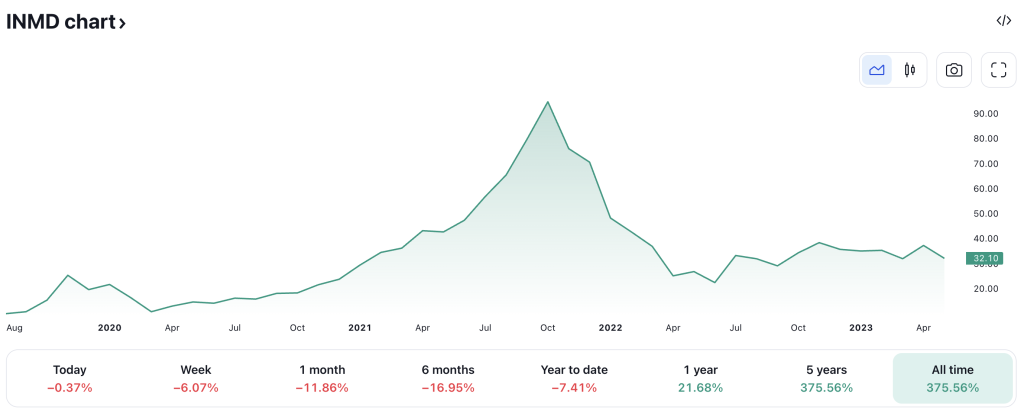

InMode Ltd. ($INMD)

Source: TradingView

???? Summary:

Share price at the time of writing: $32.10

- InMode Ltd. is a leading global provider of innovative, energy-based, minimally-invasive surgical aesthetic and wellness solutions.

- $INMD sells primarily to plastic surgeons, dermatologists, and other medical professionals in the aesthetic industry, also making their innovative technology available to wellness centers and spas.

- The Company is based in Israel, with strong markets in North America and other regions globally.

- Revenues and earnings have consistently grown over the past few years despite the share price falling by 60% (approx.) since 2022.

???? What they do:

InMode provides high-tech medical devices that use a special technology called radio-frequency assisted lipolysis (RFAL). This tech is used for various beauty treatments, such as reshaping the body, refreshing the skin, removing hair, and improving gynecological health.

There are different models of these products, which means doctors can pick the ones that best fit their patients' needs.

InMode's advanced RFAL technology makes it easy to incorporate new developments quickly. Their goal is to always offer the best, most modern solutions in the beauty market.

By focusing heavily on research, development, and innovation, InMode can quickly launch new products that lead the industry.

Their main products include:

- BodyTite: A procedure that reshapes the body with minimal invasion.

- FaceTite: A procedure that gives facelifts with minimal invasion.

- AccuTite: A procedure that reshapes fat and tissue accurately.

- Morpheus8: A device that remodels and reshapes the face and body under the skin.

- Evolve: A platform that offers several non-invasive body treatments that don't need hands to operate.

- Evoke: A hands-free platform that remodels faces.

These devices are all designed to give great results to patients while causing minimal discomfort and requiring little recovery time.

InMode is mainly based in Israel, but it also has a strong presence in North America and is expanding into other parts of the world.

???? What we learned from social media and institutional investment patterns:

Since $INMD's target customers are medical professionals, social media mentions are low.

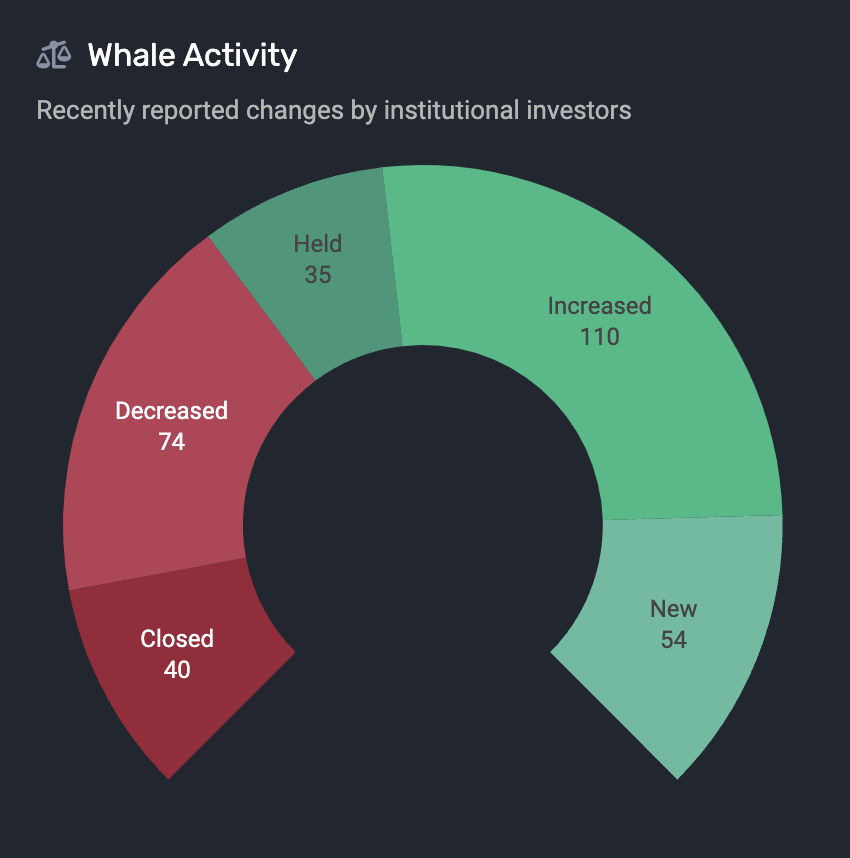

Institutions hold 45.8% of the shares, with the float standing at 35.9 million shares. A total of 246 institutions hold shares, with Blackrock and Vanguard being significant holders.

Source: quiverquant.com

The moderate level of institutional ownership combined with a reasonable float size implies that retail investors could still make significant impacts on the stock's price.

Notable comments from Reddit:

“As someone who worked in aesthetics for over 5 years.

Yes, $INMD is a buy. Launched by former executives of Syneron, And Cynosure (Please read up on both company’s yourself).” – RtzTorontoRtz

???? Smart Money Signal: Jim Simons of Renaissance Technologies increased their holdings in $INMD by 9.2% in Q1 2023.

???? Why $INMD could be valuable:

InMode operates in a fast-growing market. The global aesthetic market is expected to grow at a CAGR of 7.8% from 2021 to 2028.

$INMD caters to a market where innovation and patient outcomes are key drivers of success.

Demand for its products appear strong.

InMode reported record quarterly revenue of $133.6 million for the fourth quarter of 2022, representing a 21% year-over-year growth.

The company’s proprietary surgical technology platforms engaged in minimally invasive and sub-dermal ablative treatments represented 83% of quarterly revenues.

InMode's strong growth prospects, coupled with its growing international presence, are compelling.

According to Simply Wall St, InMode’s estimated fair value is US$56.96 based on Free Cash Flow to Equity. The current share price of US$32.10 suggests InMode is potentially 42% undervalued. Their fair value estimate is 19% higher than InMode’s analyst price target of US$47.832.

InMode is forecasted to grow earnings and revenue by 17.6% and 14% per annum respectively. EPS is expected to grow by 15.4%. Return on equity is forecast to be 22.9% in 3 years.

⚠️ What the risks are:

1️⃣ Market competition. The aesthetic solutions market is highly competitive, with many established players and new entrants. $INMD needs to continue innovating to maintain its competitive edge.

2️⃣ Regulatory risk. The company's products require regulatory approval in each country they are sold. Any changes or challenges in regulatory landscapes could impact market access.

3️⃣ Economic conditions. The aesthetic procedures market is somewhat dependent on discretionary spending, and could be affected by economic downturns.

Bottom line: $INMD is a growing company in the thriving aesthetic and wellness solutions market. Despite competitive and regulatory challenges, the company's robust product portfolio and dedication to innovation position it well for future success.

Terex Corporation ($TEX)

Source: TradingView

???? Summary:

Share price at the time of writing: $47.87

- Terex Corporation is a global manufacturer of lifting and material processing products and services that deliver lifecycle solutions.

- The company operates through a mixed model, both selling equipment directly and providing services on a contract basis.

- $TEX is relatively stable, showing consistent revenue and moderate earnings growth with manageable levels of debt.

- Shares have experienced a steady climb with minor dips and rises throughout the past year.

???? What they do:

Terex Corporation focuses on manufacturing equipment for various industries including construction, infrastructure, quarrying, recycling, energy, mining, shipping, transportation, refining, and utilities.

The company has a broad range of product lines, including:

- Aerial Work Platforms (AWPs): Articulating boom lifts, telescopic boom lifts, trailer-mounted boom lifts, and scissor lifts.

- Materials Processing (MP): Crushers, screens, shredders, conveyors, and washing systems.

- Cranes: Tower cranes, rough terrain cranes, truck cranes, crawler cranes, and boom trucks.

- Terex's equipment and services are used across diverse sectors, minimizing dependency on a single industry or customer. No single customer accounts for more than 1% of the company's total revenue.

???? What we learned from social media and institutional investment patterns:

Terex Corporation does not have a significant presence on social media, likely due to the nature of their products and services which cater to a niche industrial market.

Institutional investors hold a significant portion of the company's shares, with Blackrock and Vanguard being the dominant holders.

???? Smart Money Signal: Fisher Asset Management (run by billionaire investor Ken Fisher) currently owns 2.16 million shares in $TEX worth around $104 million.

???? Why $TEX could be valuable:

The global market for lifting and material processing equipment is expected to grow at a CAGR of 6.0% through 2030.

Terex targets a wide range of industries which allows for diverse revenue streams, reducing dependency on any single sector.

Despite uncertainties in the global economy, there is a continued demand for the company's products in sectors such as energy, mining, and construction.

Terex's solid position in the market and steady revenue growth over the years are compelling.

Terex has also shown a commitment to returning capital to shareholders via dividends and share repurchases.

According to Simply Wall St, Terex’s EPS is expected to grow by 2.6%. Return on equity is forecast to be 20.7% in 3 years.

The company also upgraded its FY23 forecasts.

The revised revenue guidance now ranges from $4.8 billion to $5 billion, marking an increase of $200 million from the previous midpoint estimate.

In addition, profit margins are anticipated to achieve 10.7%, showing an improvement of 20 basis points compared to its earlier projection.

Terex’s CEO John L. Garrison stated on its recent earnings call that they are transforming from an acquisition driven company to a process driven company, with the goal of delivering top quartile operating performance and disciplined return of capital to shareholders during all phases of the business cycle.

The company maintains a solid balance sheet, with moderate levels of debt and a healthy cash position.

14 analysts currently cover Terex. Seven rate it “Strong Buy”, three say “Buy”, and four say “Hold”.

⚠️ What the risks are:

1️⃣ Terex's revenue growth could be impacted by fluctuations in the global economy. A downturn in the industries it serves, such as construction or energy, could lead to reduced demand for its products.

2️⃣ The company operates in a highly competitive market, with many players providing similar products. This competition could lead to price pressures and affect margins.

3️⃣ Terex is also exposed to fluctuations in commodity prices, which can affect its manufacturing costs.

Bottom line: Terex Corporation is a stable player in the lifting and material processing industry. The company has a solid foothold in the market and enjoys diverse revenue streams. While the company faces risks associated with economic fluctuations and competitive pressures, its solid financials and steady growth make it worth further investigation.