Let's get into this week’s report. Here’s what we found:

- A gaming company that doesn't make games but is expected to generate $1.4 billion in revenue this year.

- A Chinese EV company that went from no revenue in 2018 to $1.45 billion of sales in 2020

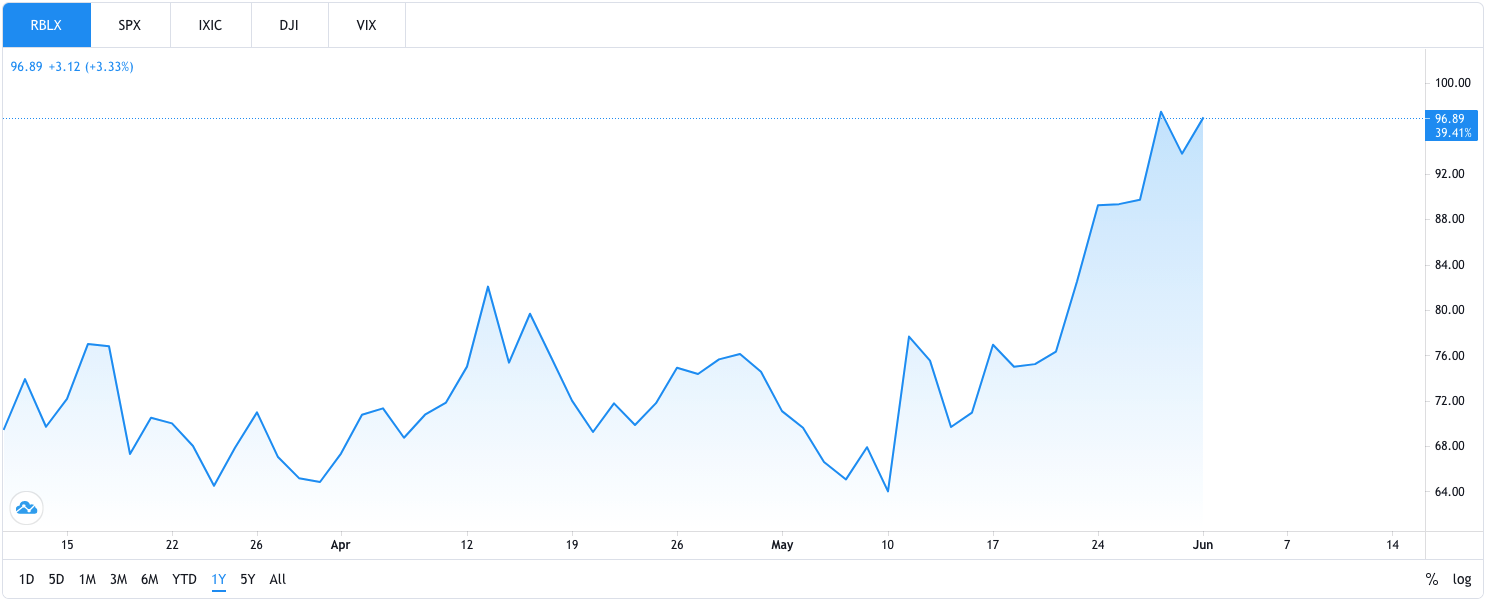

Roblox Corporation ($RBLX)

$96.89 – Share price at time of writing

Source: tradingview.com

Summary:

- Roblox could be described as the YouTube of game development and game consumption.

- Roblox allows anyone to be a game creator. You can build games on the platform (without any coding skills) and sell those games to users on the platform.

- The platform has its own economy. Robux is used as currency to purchase games and for micro-purchases within those games.

- Roblox has the potential to successfully expand into verticals outside of gaming.

- There are both opportunities and risks of being a children-centric platform, but the risk is small compared to the potential upside.

What they do:

Roblox, unlike other gaming companies, does not make its own games.

Similar to YouTube, Roblox relies on individual developers to create their content. Through this, Roblox is creating a metaverse.

A metaverse is a virtual-reality space where users can interact with a computer-generated environment and other users. The Roblox platform could bring exciting new opportunities not only for game developers, but also advertisers, entertainers, and educators.

In 2020, mobile gaming platforms like Roblox saw explosive growth in revenue as users flocked to these platforms during coronavirus-enforced lockdowns.

Today, Roblox has more than 32 million daily active users and over 8 million developers on its platform.

Why they’re spiking in interest:

According to MarketStream.io, the total Reddit mentions of Roblox have increased by roughly 400% in May compared to the total mentions in April.

The growth in mentions was likely driven by news coverage on Gucci's virtual exhibition hosted on Roblox.

The event featured a limited digital version of the“Gucci Dionysus Bag with Bee” for one hour – with over 400 users snapping it up for 475 Robux (roughly $6).

The surprising part was that the bag was re-sold for 350,000 Robux (about $4,115). Which was more expensive than the real bag's price of $3,400.

????Signal: Investment funds managed by Cathie Wood, Tiger Global and Ken Griffin purchased nearly $4 billion worth of RBLX shares in Q1 2021. Source – cheaperthanguru.com

Why RBLX could be valuable:

Roblox is a highly profitable business that's growing rapidly in scale.

The Roblox platform is powered by advanced proprietary technology. Developers create content using Roblox Studio, and consumers (gamers) access this content through Roblox Client (interface to 3D digital worlds).

Money is made through the sale of Roblox's virtual currency – Robux, which players use to make in-game purchases.

In 2020, Roblox's business was boosted by the coronavirus pandemic as mobile gaming saw exponential growth. As AR/VR technology becomes more mainstream over the coming years, this will also help Roblox drive future revenue growth.

In 2021, Roblox is expecting revenue to grow from $923 million to around $1.4 billion. However, bookings are projected to rise by just 10% year-over-year (near-stagnation), and free cash flow is set to decline too.

The company is well-capitalized and is already generating free cash flow, so it is unlikely Roblux will need to issue more shares to fund future growth.

The growth of Roblox has been driven by two key network effects: content and social.

Roblox's platform is powered by user-generated content that's built by an engaged community of developers and creators.

As Roblox's developers and creators build increasingly high-quality content, more users are attracted to their platform. The more users on the platform, the higher the engagement and the more attractive Roblox becomes to developers and creators.

With more users, more Robux (Roblox's virtual currency) is spent on the platform, which in turn incentivizes developers to build more engaging content for users and attracts new developers and content creators to the Roblox developer community.

The social aspect makes this cycle even more powerful.

Roblox's users usually play with friends, this leads them to invite more friends to the platform, who, in turn, invite their friends, creating a viral loop.

Roblox's mission is to build a human co-experience platform that enables shared experiences among billions of users.

The idea of a metaverse has been written about by futurists and science fiction authors for over 30 years. With the rise of increasingly powerful consumer computing devices, cloud computing, and high bandwidth internet connections, Roblox is well-positioned to make this a reality.

What the risks are:

Despite the recent correction in high-growth tech stocks, Roblox has surprisingly held on to its IPO gains.

Although the future is bright for Roblox, trading at 113x its current earnings with a market capitalization of $53b, the stock currently seems overvalued. The stock would become more attractive if it starts to trade between the $60-$70 range.

Roblox's growth numbers for 2020 were impressive. However, the expectations for 2021 aren't as bright (and rightly so). With the pandemic fading away and life returning back to normal, a reduction in hours spent on gaming is almost a certainty.

Li Auto, Inc. ($LI)

$23.81 – Share price at time of writing

Source: tradingview.com

Summary:

- The world is waking up to climate change, creating massive opportunities for electric vehicle companies. However, competition will be fierce.

- China is on track to achieve sustained EV growth of 51% in 2021.

- Li Auto focuses on EREV vehicles – a combination of BEV (Battery Electric Vehicle) and ICE (Internal Combustion Engine) vehicles.

- The company is growing insanely fast. In Q1 2019, it generated $40.9 million.

- By Q4 2020, Li Auto reached $369.8 million in revenue and by the end of 2020 had achieved $635.3 million of revenue.

What they do:

Li Auto was founded in 2015 and started production of its first vehicle, Li ONE, in November 2019.

By December 31, 2020, the company already delivered over 33,500 Li ONEs. The company is a pioneer in successfully commercializing EREVs in China.

The Li ONE is a premium EREV SUV, and the only Li product on the market.

Unlike its Chinese EV rivals such as NIO and XPeng, Li Auto stands out with its differentiated EREV offering.

EREV (extended-range electric vehicles), offers customers most of the benefits of owning an electric vehicle – mainly exposure to many government incentives – while maintaining the refueling and distance capabilities of regular cars with internal combustion engines.

All of its revenue currently comes from customers in China.

Why they’re spiking in interest:

According to MarketStream.io, Reddit mentions of $LI during May 2021 increased by approximately 150% compared to the previous month.

Li Auto has had around 7,900 Reddit mentions in total and appears to be flying under the radar compared to NIO (169,000 total mentions) and XPeng (15,000 total mentions).

The recent growth in mentions was likely due to news coming out that Tesla’s sales in mainland China declined by nearly 30% after a number of angry customers raised concerns about the safety and quality of its Shanghai-made EVs.

These events are expected to work in the favor of Chinese EV manufacturers including Li Auto.

????Signal: Tiger Global, Ken Griffin and Ray Dalio currently hold $20 million worth of $LI shares as of Q1 2021. Source – cheaperthanguru.com

Why LI could be valuable:

As a result of the pandemic and the semiconductor shortage, EV companies have had to be more conservative, resulting in a 13% reduction in LI's Q1 2021 production from Q4 2020.

Despite the chip shortages, China is set for a sustained period of solid EV growth of 51% in 2021.

On May 25, 2021, LI officially released a statement about the launch of their 2021 Li ONE. The world's first vehicle with navigation on autopilot (NOA) as a standard configuration.

With NOA, drivers simply enter their destination and the vehicle's system will not only take over the driving but also take over the navigation as well.

This includes changing lanes to get around slower vehicles and getting in the right lane to merge onto the next freeway or exit.

2021 Li ONE underwent extensive upgrades, including software and hardware optimization and an integrated Powertrain system. Its fuel economy mode manages 1.6 gallons per 62 miles under NEDC-standard operating conditions, which is the best in class among large four-wheel-drive SUVs. Delivery of the 2021 Li ONE will commence on June 1st.

With a premium electric SUV offering, Li stands to benefit from the booming wealth of Chinese consumers.

China is now home to over 20% of the world's middle class and is experiencing the fastest expansion of the middle class the world has ever seen.

In 2018, according to the Credit Suisse 2019 Global Wealth Report, China has surpassed America in having the highest number of residents in the top 10% of the world's wealth. The wealth creation in China is showing no signs of slowing down.

This has played a key role in Li Auto's growth and will likely fuel its future growth.

The company went from no revenue in 2018 to $1.45 billion of sales in 2020. In 2021, the company is expected to more than double its revenue to over $3 billion, and grow another 76% in 2022 to $5.3 billion.

At current prices, Li Auto is currently sitting at a reasonable 3.2 times forward sales. This is a significant discount to Tesla's 10.5 times forward sales. $LI is also growing twice as fast – Tesla is expected to grow revenues by 57% in 2021 compared to Li Auto's 107%.

What the risks are:

Li Auto is still is a very young company, with limited experience in volume production. There is the risk of the company running into scaling problems as if it grows as expected.

The company's product offering is also quite limited. The company currently relies on revenue from a single car model: the Li ONE. The company's future depends on its ability to drive the technological and commercial development of EREV technologies.

Despite its rapid growth in revenue Li Auto has never been profitable and is only in its second year of volume production.

Disclaimer: The information that Ticker Nerd provides is general in nature as it has been prepared without taking account of your objectives, financial situation or needs. It does not constitute a recommendation to buy or sell any stock. This email is not intended as legal, financial or investment advice and should not be construed or relied on as such. Ticker Nerd is not responsible for any damages. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Ticker Nerd has no position in any stocks mentioned.