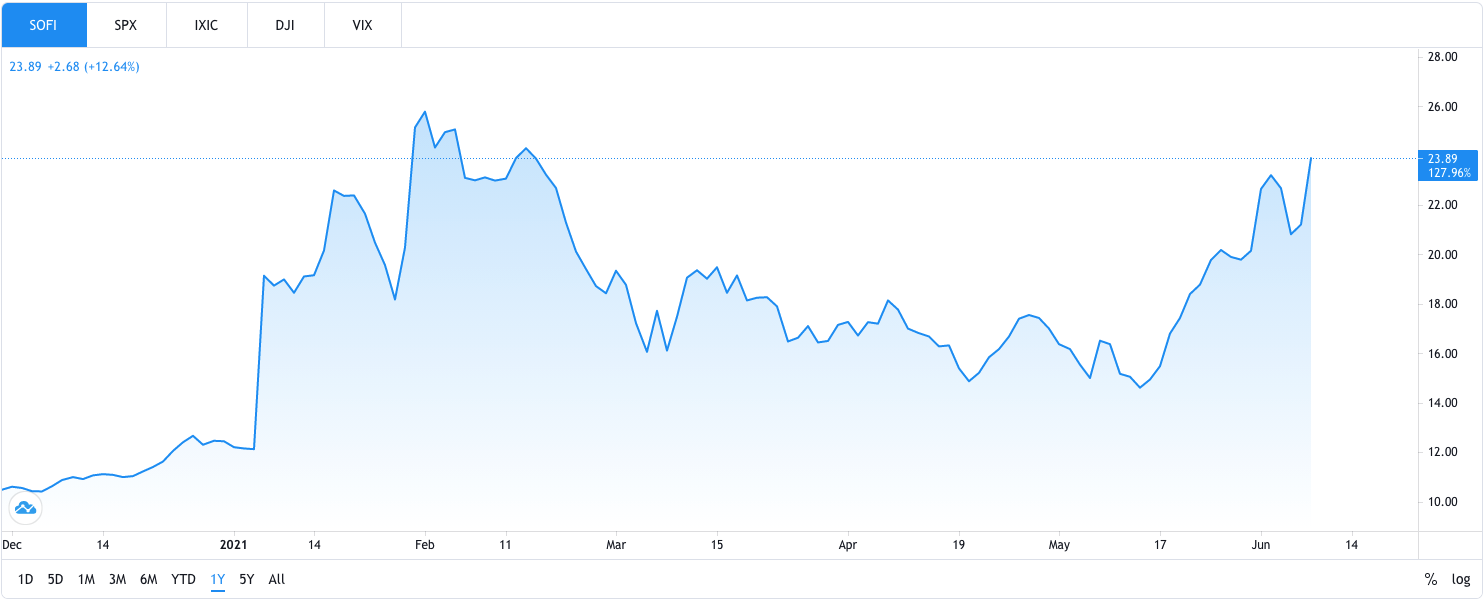

SoFi Technologies ($SOFI)

$23.89 – Share price at time of writing

Source: tradingview.com

Summary:

- SoFi is a fast-growing American personal finance company that offers a suite of financial products to consumers directly through its app and website.

- The company went public via Chamath Palihapitiya's SPAC Social Capital Hedosophia Holdings Corp. V.

- SoFi saw a year-on-year revenue increase of 151% while the number of members it has surged by 110% year-on-year to 2.28 million.

- SoFi also recently merged with Galileo, a leading fintech infrastructure platform serving upcoming neo banks.

What they do:

Social Finance (SoFi) was founded in 2011 by college students from Stanford University. They started as a community-based student debt management platform that helped students with financing loans.

SoFi's core offering now allows users to borrow, save, spend and invest for their future. Providing members with lending services such as student loans, home loans, personal loans and have recently started offering auto loans.

SoFi also provides crypto trading and share trading brokerage services that have a focus on long-term investing.

It also recently merged with Galileo. Galileo isn’t a bank and isn’t a regulated entity, but rather empowers other fintech platforms.

Galileo provides an API (Application Programming Interface) and all the technology required to offer digital banking services without having a physical bank.

Why they’re spiking in interest:

According to MarketStream.io, the total Reddit mentions of SoFi have reached nearly 700 mentions since June 1 this year.

To put this amount of mentions into perspective, Ally Financial one of SoFi's close competitors had roughly 10 mentions over the same period.

SoFi only recently began trading under its own stock ticker after its SPAC merger which is why there are less than 1-2 weeks of data.

Notable comments from Reddit:

“I'm going long on SOFI and just completed a refinance loan for my house and the process was smooth as butter.” – kevin24lg (06/07/21)

“I’ve literally dumped all sh*t tier meme stocks and now own 1,500 shares of SoFi. Galileo, the millennial student loan refi moat, bank charter, etc. and only a $17b market cap.” – datingadviceThrow789 (06/04/21)

????Signal: Aside from the SPAC merger being led by the highly successful venture capital investor Chamath Palihapitiya, according to PitchBook, SoFi has also raised cash from venture capital giants such as SoftBank and Peter Thiel.

Why SOFI could be valuable:

SoFi’s business can be structured into 3 key segments: lending, financial services and Galileo.

Lending: this part of the business covers the loans SoFi offers to its users e.g. student loans, personal loans, home loans. SoFi's lending segment accounted for 78% of total revenue generated during Q1 2021 and was up 107% compared to Q1 2020.

Financial services: this refers to the banking services SoFi provides including stock and crypto brokerage services, savings accounts as well as its market-beating credit card that offers 2% unlimited cash back on all purchases.

Its lending and financial services work together to acquire more customers while boosting their lifetime value.

For example, SoFi can attract a customer through a competitive student loan refinancing offer. It then can upsell or cross-sell other financial products like home loans or share trading services.

As these products become embedded into the customer's financial situation it makes it harder for them to switch to another provider. Further increasing the lifetime value of the customer to SoFi.

Galileo: Galileo provides new digital banks and start-ups with third-party access to core systems and functionality so that they can integrate digital banking and payment services into their own product.

Galileo is used by over 90% of all digital banks in North America and over 70 of the top 100 Fintech companies globally, with clients including Revolut and Robinhood according to data from Forbes.

By combining these segments SoFi is able to serve both B2B and B2C customers allowing them to differentiate in an increasingly competitive fintech environment.

The company grew Q4 2020 Revenue 194% YoY leading to a full year net revenue of $621M, which grew 38% from 2020.

Looking ahead in 2021, the company provided a Q1 2021 guidance of $190-195m for Q1 which it beat by $26m resulting in a year-on-year increase of 151%. Its full-year guidance of $980m represents 58% YoY growth and expects $27M in EBITDA.

The brand recognition of SoFi within its target market of millennials has also grown rapidly.

The Reddit Robinhood saga earlier this year saw a huge number of users abandon Robinhood after being blocked from making trades. SoFi was seen as a solid alternative, evident in the spike in search interest according to Google Trends.

SoFi also announced a 20-year partnership with the Los Angeles Chargers and a stadium naming rights partner in September 2020. This partnership will help continue to drive brand recognition for SoFi among its target market.

What the risks are:

There is significant competition around all areas of SoFi's business model.

This includes competition from investing platforms like Robinhood as well as digital banking platforms like Square’s Cash App, MoneyLion and Chime.

There are also well-established competitors with deep pockets like JPMorgan and Goldman Sachs who are investing heavily into fintech start-ups and already compete on SoFi's primary banking services.

The key drivers to make sure SoFi can keep winning include the comprehensiveness of its platform, ease of use, market-beating rates, Galileo’s platform, and attracting and retaining the millennial market.

FinVolution Group ($FINV)

$8.34 – Share price at time of writing

Source: tradingview.com

Summary:

- FinVolution provides financial services to borrowers using funding from traditional financial institutions.

- The company currently operates in the credit services market in China as well as other markets in South-East Asia.

- Its revenue increased by over 60% for the quarter reaching $284 million.

- Management expects a minimum increase of 50% in loan volume in 2021.

- Despite the share price increasing 345% over the past year, insiders have continued to buy more FINV shares.

What they do:

FinVolution Group is an online consumer finance platform in China connecting underserved individual borrowers with financial institutions.

The company has market-leading technology and experience in credit risk assessment, fraud detection, big data and artificial intelligence.

The company's platform is powered by proprietary cutting-edge technologies, featuring an automated loan transaction process, which allows it to offer an exceptional user experience.

Why they’re spiking in interest:

According to Gambiste.com, the Twitter score for $FINV over the past 3 months has increased by 71.79.

Gambiste.com uses a proprietary algorithm that filters out spam and weighs each user mention depending on the account's reputation.

The recent growth in mentions of FinVolution was likely due to its recent earnings results catching the eye of investors.

Its core loan volume more than doubled compared to the previous quarter, it recorded over 1 million new borrowers in a single quarter and also stated that 80% of its existing borrowers turn into repeat customers.

????Signal: Billionaire hedge fund manager Ken Griffin purchased 437,000+ shares in FINV during Q1 2021. Source – cheaperthanguru.com

Why FINV could be valuable:

FinVolution Group, formerly known as PaiPaiDai originally offered peer-to-peer (P2P) loans as its main offering.

These loans work by investors providing funding for borrowers who are then able to access loans they would normally be rejected for from traditional lenders. Investors then earn interest as the debt is paid off.

Due to loan delinquencies and increasing regulations in the industry FinVolution discontinued its P2P platform to focus solely on connecting borrowers to traditional lenders.

The company's new business model focusing on high-quality borrowers has resulted in larger loans on average although with lower rates. FinVolution receives a commission for every loan funded that they refer.

The company acquires these borrowers through several growth channels including app stores, online advertising on platforms like WeChat and Tik Tok. search engine marketing and a referral network.

Originally focusing on mainland China, the company has also expanded to other Asian countries including Indonesia, the Philippines and Vietnam.

In FinVolution's recent earnings results the company revealed that its core loan volume (its key metric) more than doubled to hit RMB 26.8 billion ($4.19 billion USD) compared to the same period 12 months before.

Although the Chinese market made up more than 97% of this number, FinVolution's international business continues to outpace the mainland.

Despite these Asian countries being smaller than the market in mainland China, there is less competition and existing providers offer more primitive options compared to FinVolution's platform.

The company reported an increase in loans funded by over 40% alone in Q1 2021. This trend along with the fact that delinquency rates improved significantly in the past quarter (after shifting to higher-quality borrowers) meant that operating profit increased by 45% over the past 12 months o hit RMB 671 million ($105 million USD).

FinVolution's customer satisfaction has also increased dramatically. With roughly 80% of borrowers returning as repeat customers. This helps drive the company's acquisition costs lower over time as the value of each customer they acquire goes up.

The stock price for FinVolution is also still currently underpriced. Its multiple for trailing revenue is a full 50% cheaper than its main competitors. Its forward sales multiple is also 45% lower even despite the expected slower growth.

What the risks are:

The major risks for FinVolution are an increase in regulatory requirements or a steep drop in demand for its products.

The likelihood of a drop in demand appears to be low as China is currently leading the world out of the pandemic and has been back to work for longer than most other countries.

In terms of the regulatory risk, it can be hard to predict what can happen and when. In saying that, increased regulation normally helps proven players because of the higher barrier to entry it creates for new players. This could work in FinVolution's favor.

Disclaimer: The information that Ticker Nerd provides is general in nature as it has been prepared without taking account of your objectives, financial situation or needs. It does not constitute a recommendation to buy or sell any stock. This email is not intended as legal, financial or investment advice and should not be construed or relied on as such. Ticker Nerd is not responsible for any damages. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Ticker Nerd has no position in any stocks mentioned.