Let's get into this week’s report. Here’s what we found:

- An underpriced cloud platform that helps websites make more money.

- The largest steel production company in the US poised to profit from Biden's infrastructure stimulus.

Fastly, Inc. ($FSLY)

$46.35 – Share price at time of writing

Source: tradingview.com

Summary:

- Shares of Fastly have continued their sharp decline since the start of the year, and are down ~50% from last year's highs.

- Though still expensive, the company's revenue multiple at ~15x isn't out-of-line with other hyper-growth tech stocks.

- Fastly has a massive market opportunity ahead that includes customers of all types of verticals. Its usage-based pricing model allows it to grow alongside its clients.

- Scale has also brought efficiencies, and Fastly's gross margin profile is increasing at a steady rate.

What they do:

Fastly is a content delivery network (CDN) company that helps users view digital content more quickly.

Nearly every website on the Internet needs to use a CDN to improve the page-load time of the site. Site speed is a major ranking factor on search engines such as Google and Bing.

A page that takes five seconds to load will see 38% of visitors leave the site while pages that load within two seconds only lose an average of 9% of visitors. This can have a huge impact on the success of any online business.

Why they’re spiking in interest:

According to MarketStream.io, the total Reddit mentions of FSLY has increased by over 2500% compared to the previous month.

The spike in mentions of FSLY has continued to increase as the share price continues to fall. The share price is much closer to the bottom of its 52-week range of $33.01 than its peak of $136.50.

Investors believe the recent correction has made Fastly undervalued and maybe an opportunity to buy the stock at a discount.

Notable comments from Reddit:

“Imagine not buying the FSLY dip.” – 13RAH (05/06/21)

“Yolo'ed my entire account (200k) into FSLY shares at $42

” – us1549 (05/07/21)

Signal: Cathie Wood's ARKW ETF increased its position in Fastly during Q4 2020 by +1.14 million shares. Source – cheaperthanguru.com

Why FSLY could be valuable:

The sharp correction in tech stocks since the beginning of the year has hit some stocks harder than others. Among the richly-valued growth stocks, Fastly has been one of the biggest decliners.

Although, Fastly's fundamentals and growth story haven't changed over the past year. Instead, investors have become more vigilant on valuations which is the main reason behind the decline in share price.

In their recent Q1 2021 report, Fastly's total customer count increased to 2,207 from 2,084. An increase of 123 customers, the largest number the company has ever reported.

Fastly's Q4 2020 revenue grew at a 40% year-on-year pace to $82.6 million, boosted by their acquisition of Signal Sciences as well as organic customer growth. Showing only a small dip from its revenue growth in Q3 2020 of 42% year on year.

Fastly doubled down on its growth plans by acquiring Signal Sciences for $775 million in cash and stock late last year. Signal Sciences offers developer-first web application and API protection solutions. This will boost Fastly’s existing security offerings to bring customers a more comprehensive edge security solution.

Fastly relies on a usage-based business model. This means their profit margins will increase as its customers use more of its services.

Fastly serves customers in several verticals that have seen strong revenue growth: gaming, financial services, education, and telecom. This allows Fastly to diversify its customer base but also benefit from the growth of these industries.

Fastly's dollar-based net expansion rate (a measure of how much more its customers spend on its platform versus the prior year) was 143%in Q4 (versus around ~110% for most software peers).

What the risks are:

Fastly operates in a competitive space up against the likes of Akamai Technologies and Cloudflare. Although CDNs are an essential service for Internet businesses it can be difficult to differentiate and stand out from other providers.

Fastly also needs to continue to meet its revenue guidance over the next financial year. This will prove to investors the company is undervalued and can maintain high levels of growth.

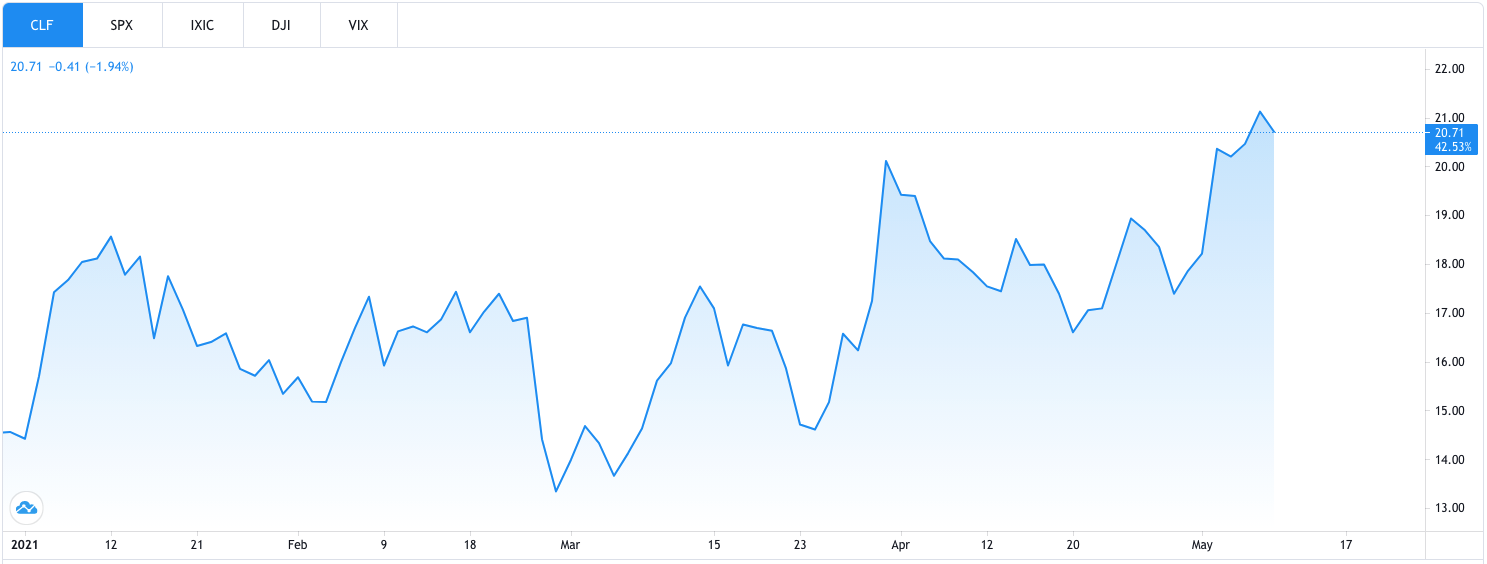

Cleveland-Cliffs, Inc. ($CLF)

$21.38 – Share price at time of writing

Source: tradingview.com

Summary:

- Cleveland-Cliffs is transforming itself into a key player in the US steel industry.

- The company now has some of the most enviable assets in the steel sector having both a low-cost structure and an ability to serve high-margin markets.

- CLF has positioned itself as a replacement for the foreign-sourced pig iron that many US steelmakers have depended upon.

- This transformation has been through the leadership of Lourenco Goncalves, a rare CEO, who is both visionary and practical.

What they do:

Steel is in short supply in the United States and prices are surging.

Unfilled orders for steel in the last quarter were at the highest level in five years, while inventories were near a 3-1/2-year low, according to data from the Census Bureau. The benchmark price for hot-rolled steel hit $1,176/ton last month, its highest level in at least 13 years.

Cleveland-Cliffs is one of the lowest cost, highest quality, iron ore pellet producers in the US because of its transportation and logistics advantages in the Great Lakes region.

The company's vertical integration gives it one of the lowest raw material cost profiles among steel suppliers. It has diversified its customer base while giving it access to high-margin products (automotive, HBI) and pricing leverage in a cyclical market.

Why they’re spiking in interest:

According to MarketStream.io, Reddit mentions of CLF have more than doubled the previous month already despite being less than halfway through May.

Interest has picked up in infrastructure and commodity stocks as investors look for alternatives to tech stocks.

Notable threads from Reddit:

- Has tech got you down? Consider commodities, in particular, steel. For a variety of reasons

- Biden's Infrastructure plan and who benefits?

- Cleveland Cliffs (CLF) rating upgraded by B. Riley to $33 ! post Biden Infra plan

Notable comments from Reddit:

“Guess I’m bucking the trend here, CLF is printing. Get out of tech and into steel and copper.” – Seatown1983 (05/10/21)

“I bought some CLF for 17.8 yesterday, intending a long play in a non-tech sector with potential for decent growth.” – CarpenterSouthern313 (05/05/21)

Signal: Billionaire hedge fund manager Ken Griffin increased his position in Cleveland-Cliffs during Q3 2020 by +8.4 million shares and is still currently holding. Source – cheaperthanguru.com

Why CLF could be valuable:

Cleveland-Cliffs is the largest flat-rolled steel producer in the US. Infrastructure stimulus is a key policy initiative of the Biden administration, which will require a substantial amount of steel.

The market for steel and iron ore isn't just limited to the US with China being one of the largest consumers of iron ore and producers of steel on the planet.

The company's transformation from an ore producer into a forward-looking leader in the US steel industry is tied directly to their CEO Lourenco Goncalves’ strategic vision, consistent execution plus high levels of skill and confidence.

CLF now controls its own steelmaking chain from raw ore to finished CLF-made steel and has set itself up as a high-quality supplier of production materials for use by other steelmakers.

The strategy is designed to both achieve vertical and horizontal integration.

The vertical integration chain starts with its own mine and continues with ore processing and CLF’s own steel manufacturing. Now that CLF has taken on the role of a supplier to other steel manufacturers this has expanded the company's profit opportunities significantly.

CLF has positioned itself as a replacement for the foreign-sourced pig iron that many US steelmakers have depended upon.

CLF is a low-cost, integrated value chain, serving a diversified customer base. Its management is also planning to reduce risk even further by de-levering its balance sheet. The plan has resources behind it and its management has demonstrated its ability to execute time and again.

It is well-positioned to benefit from the continued demand for steel and iron ore in several growing industries (automotive, infrastructure and housing) and can supply other steel manufacturers effectively.

What the risks are:

The price of commodities such as iron and steel rise and fall. Should external events cause a correction in the price of steel or iron, CLF and its share price will be affected.

The company also has significant debt – but without debt companies also do not grow – and CLF is growing rapidly. CLF's management team are also focusing on reducing debt as much as possible over the next 1-2 years.